DEPREC table: List of sections sorted by functionality

Presentation

This document describes the content of the data table DEPREC, the sections are grouped according to various functionalities covered by the Fixed assets module.

The DEPREC table contains all data updated by the calculation of depreciations and associated business actions.

The number of recordings in this table is linked to the number of fiscal years to be calculated specified in the setup of each Context.

Key of this table:

AASREF (Asset reference)

+ DPRPLN (Depreciation plan)

+ FIYENDDAT (Fiscal year end date)

+ PERENDDAT (Period end date)

- General information

- Valuation of the asset

- Depreciation setups

- Depreciation amounts - Actual tracking

- Depreciation amounts - Initial tracking

- Depreciation amounts - Theory tracking

- Re-evaluation

- Impairment loss

- Special depreciation of fiscal reintegration

- Amounts to post

- Posted amounts

- Tax on vehicles

- Deferred depreciation

- Depreciation method change

- Technical sections

- Concession contracts

Content of the DEPREC table, sorted by category

General information

Section | Description | Notes |

AASREF | Asset reference |

|

CPY | Company |

|

FCY | Financial site |

|

CNX: | Context |

|

DPRPLN | Depreciation plan |

|

FIYENDDAT | Fiscal year end date | Context issue |

FIYSTRDAT | Fiscal year start date | Context issue |

PERENDDAT | Period end date | Context issue |

PERSTRDAT | Period start date | Context issue |

RATCUR | Currency exchange rate |

|

UOM | Unit |

|

Valuation of the asset

Section | Description | Notes |

BSEVAL | Initial balance sheet value |

|

DPRBAS | Revalued balance sheet value |

|

If the BSEVAL and DPRBAS values are different, the asset will be considered as revalued.

Depreciation setups

Section | Description | Notes |

STRDPRDAT | Depreciation start date | Date |

ENDDPRDAT | Depreciation end date | Date |

ENDDPRFLG | Forced depreciation write-off | RA Mode only |

DPRDUR | Depreciation duration | Duration |

RSDDUR | Residual duration | Duration |

DPM | Depreciation method | Method |

DPMI | Depreciation method - Initial tracking | Method |

DPMT | Depreciation tracking method - Theory tracking | Method |

DPRRAT | Depreciation rate | Rate |

DPRRAT2 | Depreciation rate 2 (Italian method) | Rate |

DPRRATFLG | Depreciation rate forcing flag | Rate |

ACLCOE | Acceleration coefficient | Acceleration coefficient |

PRATYP | Prorata | Day, Month… |

ALWAMT | FY specific rule amount | Specific rule |

ALWAMTFLG | FY specific rule amount forcing flag | Specific rule |

ALWCOD | Specific rule type | Specific rule |

ALWCUM | Fiscal help total | Specific rule |

ALWCUMFLG | Fiscal help total forcing flag | Specific rule |

FIYQTY | FY OPE | UO |

PERQTY | Period OPE | UO |

PERQTYCUM | UO total FY closed periods | UO |

RSDQTY | UO residual duration period start | UO |

Depreciation amounts - Actual tracking

Section | Description | Notes |

DPRCUM | FY depreciation total | E-1 |

DPRCUMFLG | FY depreciation total forcing flag | E-1 |

PERCLOCUM | Closed periods per. amount total | P-1 |

PERENDDPE | Per.charge amount Current period | P |

PERDPEFLG | Period charge forcing flag | P |

ENDDPE | Fiscal year charge | E |

ENDDPEFLG | FY charge forcing flag | E |

NBV | Period end net value |

|

RSDVAL | Residual value |

|

EXCCUM | Total excep. amt. | Except. deprec. |

EXCDPR | FY exceptional depreciation | Except. deprec. |

PERCLOEXC | Except. closed period total amount | Except. deprec. |

PEREXCDPR | Current period exceptional deprec. | Except. deprec. |

PERREFCLC | Per. For calculation |

|

"Actual" depreciation amounts take into account the Revaluations and Depreciations.

Depreciation amounts - Initial tracking

Section | Description | Notes |

EXECLOCUMI | Ini. clos. FY total | E-1 |

PERCLOCUMI | Ini. clos. total | P-1 |

DPEI | Reev. and depre. excluded inti. charge | P |

ENDDPEI | FY charge | E |

NBVI | Net value deprec. excluded |

|

PEREXCDPRI | Per. except. depr. I | Except. deprec. |

EXCCUMI | Total excep. amt. I | Except. deprec. |

EXCDPRI | Exe except. amount I | Except. deprec. |

PERCLOEXCI | Total P-1 exc amt I | Except. deprec. |

PERREFCLCI | Per. for Calcul I |

|

"Initial" depreciation amounts do not take into accountRevaluations or Depreciations.

Depreciation amounts - Theory tracking

Section | Description | Notes |

EXECLOCUMT | Theo. clos. FY total | E-1 |

PERCLOCUMT | Theo. clos per total | P-1 |

DPET | Theo. charge deprec. excluded | P |

ENDDPET | Fiscal year charge T | E |

NBVT | Net value deprec. excl. |

|

EXCCUMT | Exc. E-1 Theo | Except. deprec. |

EXCDPRT | Amt except. exe T | Except. deprec. |

PERCLOEXCT | Exc amt P-1 total | Except. deprec. |

PEREXCDPRT | Per. except. depr. T | Except. deprec. |

PERREFCLCT | Per. for Calcul T |

|

"Theory" depreciation amounts take into accountRevaluations but do not take into account Depreciations.

Re-evaluation

Section | Description | Notes |

RVAAMT | Period revaluation amount | P |

RVACRB | Revaluation increase | P |

EXERVADEV | Reval closed FY tot | E-1 |

PERRVADEV | Reval per closed tot | P-1 |

PERRVACUM | P-1 total revaluation amount | P-1 |

RVACOE | Revaluation coefficient |

|

RVACOEREF | Table reference |

|

RVADAT | Revaluation date |

|

RVATIADAT | Reval. effectiveness |

|

RVATYP | Revaluation method |

|

Impairment loss

Section | Description | Notes |

NSPVAL | Market value |

|

IML | P Period impairment loss | P |

IMLRVE | P Period impairment loss reversal | P |

IMLBLC | Period start depreciation balance |

|

IMLRVELIM | Impairment loss reversal limit | P |

IMLRVETRF | Recovery of Impairment loss in Exc amt | P |

PERIMLCUM | Impairment loss total P-1 | P-1 |

PERRVECUM | Impairment loss recover total P-1 | P-1 |

PERTRFCUM | Recover imp. loss to transfer in amt. exc. P-1 | P-1 |

EXEIMLCUM | Impairment loss total E-1 | E-1 |

EXERVECUM | Impairment loss recovery total E-1 | E-1 |

EXETRFCUM | Recover imp. loss to transfer in amt. exc. E-1 | E-1 |

IMLFLG | Forced P Period impairment loss |

|

IMLRVEFLG | Impairment loss forced recovery |

|

IMLTYP | Impairment loss type |

|

INTIMLTYP | Impairment loss intern reason |

|

EXTIMLTYP | Impairment loss extern reason |

|

Special depreciation of fiscal reintegration

Section | Description | Notes |

LEGCUM | Legal link total E-1 | E-1 |

PERLEGCUM | Legal link total P-1 | P-1 |

LEG | Legal link amount | P |

LEGRVECUM | C leg. link rec. E-1 | E-1 |

PERLEGRVE | C leg. link rec. P-1 | P-1 |

LEGRVE | Legal link recovery | P |

Notes:

- On the depreciation plan Accounting (DPRPLN=1), these amounts are used for the Special depreciation (French legislation).

- On the depreciation plan Financial (DPRPLN=2), these amounts are used for the Fiscal reintegration (French legislation).

Amounts to post

Section | Description | Notes |

DPEDEV | Charge to post |

|

EXCDEV | Exc. to post |

|

DERDEV | Special dep. to post | Special amount |

DERRVEDEV | Special dep. recovery to post | Special amount |

RVACRBDEV | Repr. Reval. recov. to post | Revaluation |

RVETRFDEV | Repr. imp. loss to transf. to post | Impairment loss |

FLGDEV | To post |

|

CADCRBDEV | Amortization picking to post | CCN activity code |

Amounts "To post" switch to "Posted" during the Accounting entries generation if, at the Context level, the Posting type is set to: Actual

If the Posting type is set to: Simulation, the amounts remain "To post".

Posted amounts

Section | Description | Notes |

PSTDPE | Posted charges |

|

PSTEXC | Posted exc |

|

PSTDER | Posted special imp. loss | Special amount |

PSTDERRVE | Exceptional increase posted | Special amount |

PSTRVACRB | Rep. Posted reev. | Revaluation |

PSTRVETRF | Rec. Imp. loss to transfer posted | Impairment loss |

FLGPST | Posted |

|

PSTCADCRB | Amortization picking posted | CCN activity code |

Amounts "To post" switch to "Posted" during the Accounting entries generation if, at the Context level, the Posting type is set to: Actual

If the Posting type is set to: Simulation, the amounts remain "To post".

Tax on vehicles

Section | Description | Notes |

CRBAMT | Reintegrated amount |

|

CRBCUM | Reintegrated total |

|

CRBCUMFLG | Forced reint tot. |

|

CRBVEHCOD | Vehicle reintegration limit type |

|

These amounts are used in the FAS2855 French fiscal statement.

Deferred depreciation

Section | Description | Notes |

DFD | FY deferred finance depreciation |

|

DFDBLC | Deferred finance depre. balance start |

|

DFDLIM | FY defferable financial depre. |

|

DFDRVE | FY deferred fin. depr. rec. |

|

These amounts are update according to rules defined at the level of the Depreciation context.

Depreciation method change

Section | Description | Notes |

MTCDEVADJ | Method change variance compensation type |

|

MTCDPEDAT | Method change date |

|

MTCTIADAT | Method change effective date |

|

MTCTIATYP | Method change effectiveness |

|

MTCDPEDEVI | Amount variance because of method change | Initial |

MTCDPEDEV | Amount variance because of method change | Actual |

MTCDPEDEVT | Amount variance because of method change | Theoretical |

These amounts are updated during the (unitary or massive) action: Method change.

Technical sections

Section | Description | Notes |

DEPSTA | Closing detailed status | Closure |

LSTCLODAT | Closing date | Closure |

ETRPNT | Entry point | Specific calculation flag |

FLGMIG | Migrated | Migration |

FLGUPDISS | Modification | Issue |

APLDUR | Applied duration | Depreciation duration |

Concession contracts

Section | Description | Notes |

P_1CADCRB | Amortization picking P-1 total |

|

PERCADCRB | Amortization picking |

|

TRFCADCUM | Amortization fund |

|

These amounts are updated when the CCN activity code is set to Yes.

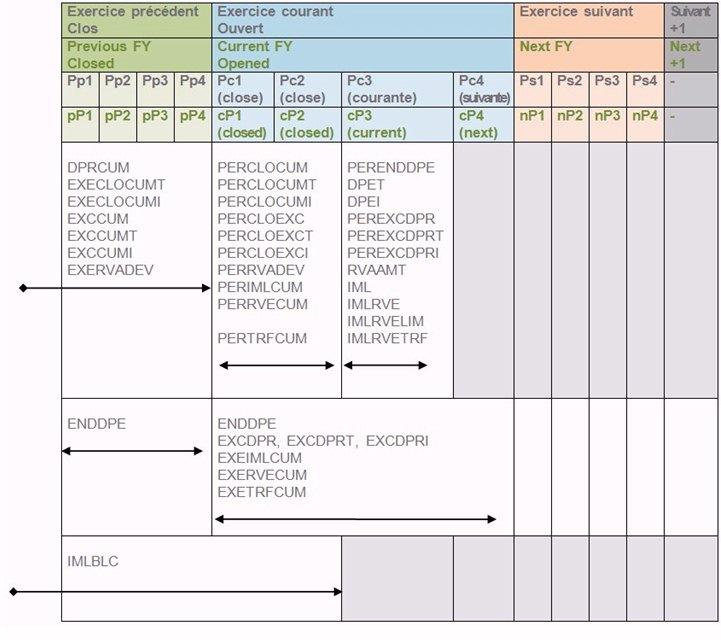

Presentation of DEPREC headings on the FY

Diagram representing the DEPREC headings on the FY